The College Conundrum

October 16, 2014

When I was an underclassmen, I worked hard every day in school, believing that would be the ticket to the college of my dreams. Now, being a senior, I have uncovered a heartbreaking truth. What separates me from the education I desperately desire isn’t my academic standing: its money.

I remember watching an episode of Family Matters when I was younger, where the daughter, Laura, was admitted into Harvard, but then was hit with the reality that her family could not afford the tuition. I was confused. Harvard is one of the best schools in the nation, how is it fair that some people can receive that education, and others cannot, just based on money? But, I didn’t worry about it, figuring I could get scholarships and grants.

Many people have this mindset, too. Unfortunately, this is often not the case. The average scholarship runs $500-$1,500. And a student will receive approximately 1 scholarship for every 10 they apply for. Say that student applies for 50 scholarships, which is an enormous amount of hours and effort, in addition to school work. That will get them about $5,000. If they want to go to a private university, like me, the average cost is above $30,000. That scholarship money barely makes a dent. In addition, many colleges offer giving their students “financial aid”. This often just means loans, which can result with college students graduating with not just a diploma, but crippling debt. The average borrower leaves with $26,000 of debt over 4 years, and 1 in 10 accumulate more than $40,000. Overall, the United States has $1.2 trillion in student loan debt.

Even community college isn’t an escape. In 2012, 38% of those graduating community college with an associate’s degree, accumulated debt.

A trillion of that debt is federal. Senator Elizabeth Warren from Massachusetts pointed out that loans issued from 2007 to 2012 are projected to yield $66 billion dollars in profit to the federal government. She explains, “The role of government has to be helping young people, instead of taxing them for making the effort.”

It’s almost unbelievable that the government has the temerity to make such enormous profits off young peoples’ education. They should be encouraging and supporting high learning, instead of thwarting it. Currently, there is a bill in progress that will cut interest rates for students in half. Our generation can only hope that bill will pass.

For many of us, it could determine the quality and quantity of higher education we can pursue. For some, it may decide if they can afford college at all.

College tuition continues to increase, while funding for public universities decreases. Every state except two have had their budgets for higher education. There is about a 28% decrease in spending per student at public universities. To simplify this, you are paying more and getting less.

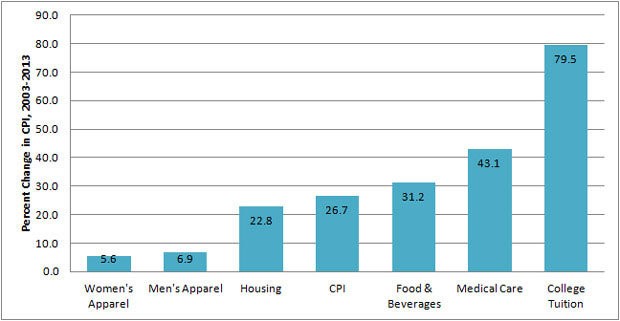

Above: “According to data from the Labor Department, the price index for college tuition grew by nearly 80 percent between August 2003 and August 2013. That is nearly twice as fast as growth in costs in medical care, another area widely recognized for fast-rising prices. It’s also more than twice as fast as the overall consumer price index during that same period.” From US News.

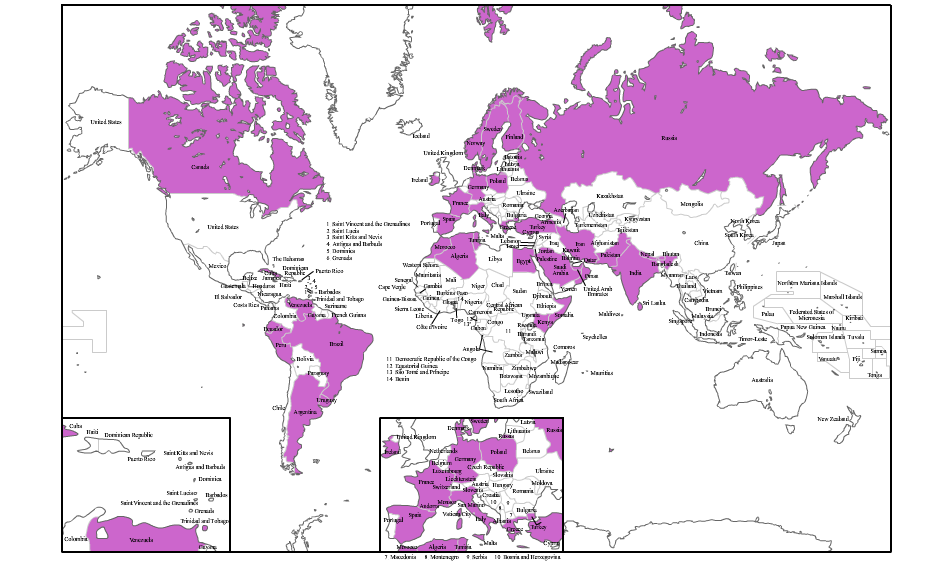

Many countries offer free college education, like Denmark, Finland, Germany, Greece, Ireland, Italy, Morocco, Pakistan, Saudi Arabia, Scotland, Spain, Sweden, and Venezuela. And that’s just to name a few.

Above: Countries that provide free post-secondary education.

In such nations, students only worry if they’ll be admitted into the college of their choosing. If you are admitted to a school in Germany, cost is never the problem. Students only have to focus on their studies to achieve their dreams. Isn’t this how it should be? Shouldn’t a student’s academic ability decide what kind of education they deserve, instead of how much they are willing to pay for it?

America isn’t the land of opportunity when opportunity comes with a hefty price tag.

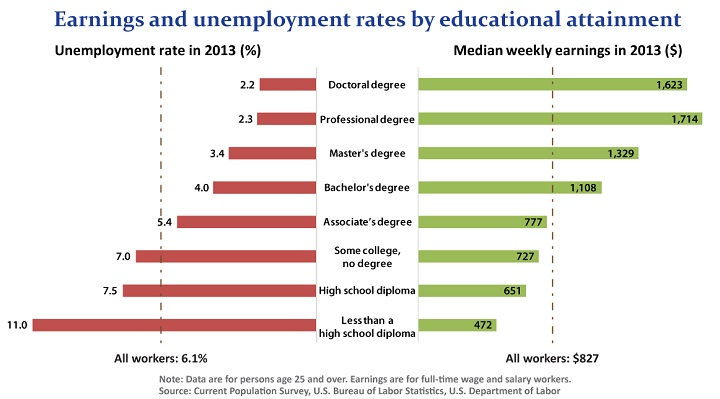

The more education you have, statistically you will have a higher salary and lower unemployment.

Above: Earnings and unemployment rates by educational attainment from the Bureau of Labor Statistics.

Ever heard the saying “it takes money to make money”? This is exactly the case when it comes to higher education. If you’re not already wealthy, how can you pay for all of this higher education, which will lead to money? Such an education system is set up to keep only the elite educated and in higher paying jobs. With staggering college tuition, it becomes nearly impossible for low income, and even middle-class students, to climb their way to the top.

In a world where having a college diploma is becoming increasingly more important, this news is unsettling. Will Bel Air High School students, and this entire generation of American students, be able to get the education they need?